April 8, 2019

Newly revised preliminary digital flood insurance rate maps for the Tyger Watershed will be available for residents to review at a public open house from 2-8 p.m. on Wednesday, April 10, 2019 at the Spartanburg County Administration Building, 366 N. Church St., Spartanburg. Flood maps show the extent to which areas are at risk for flooding and are used to help determine flood insurance and building requirements.

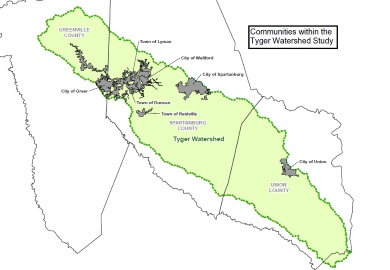

The open house provides residents of the Tyger Watershed (see map) the opportunity to see the preliminary maps, learn about their risk of flooding, and ask questions about what the new maps will mean for their property. Residents can meet one-on-one with a variety of specialists who will be available to talk about flood insurance, engineering, building permits, and more.

The complete address for the open house location is:

April 10, 2019, 2-8 p.m.

Spartanburg County Administration Building

366 N. Church Street

Spartanburg, SC 29303

The new preliminary maps were produced through a partnership among Greenville, Spartanburg, and Union Counties; the South Carolina Department of Natural Resources; and the Federal Emergency Management Agency (FEMA). They are more precise than older maps because better flood hazard and risk data make the maps more accurate. The ultimate goal is protecting property owners and the community from the risks associated with flooding. Over time, flood risks change due to construction and development, environmental changes, floodplain widening or shifting, and other factors. Flood maps are updated periodically to reflect these changes.

Home and business owners, renters, realtors, mortgage lenders, surveyors and insurance agents are encouraged to attend the open house. All who attend can meet with specialists to ask questions and learn more about flood risk and hazard mitigation within their communities.

The preliminary maps have not yet been officially adopted and will become effective after a public comment period. This period allows the public to submit comments and appeals if they can show that any part of the maps is in error. Once all comments are received and addressed, the maps may be adopted.

By law, federally regulated or insured mortgage lenders require flood insurance on properties located in areas at high risk of flooding. Standard homeowners’, business owners’, and renters’ insurance policies typically don’t cover flood damage, so flood insurance is an important consideration for everyone. Flood insurance policies can be purchased from any state licensed property and casualty insurance agent Visit https://www.floodsmart.gov/ for more information about flood insurance and to locate a local agent.